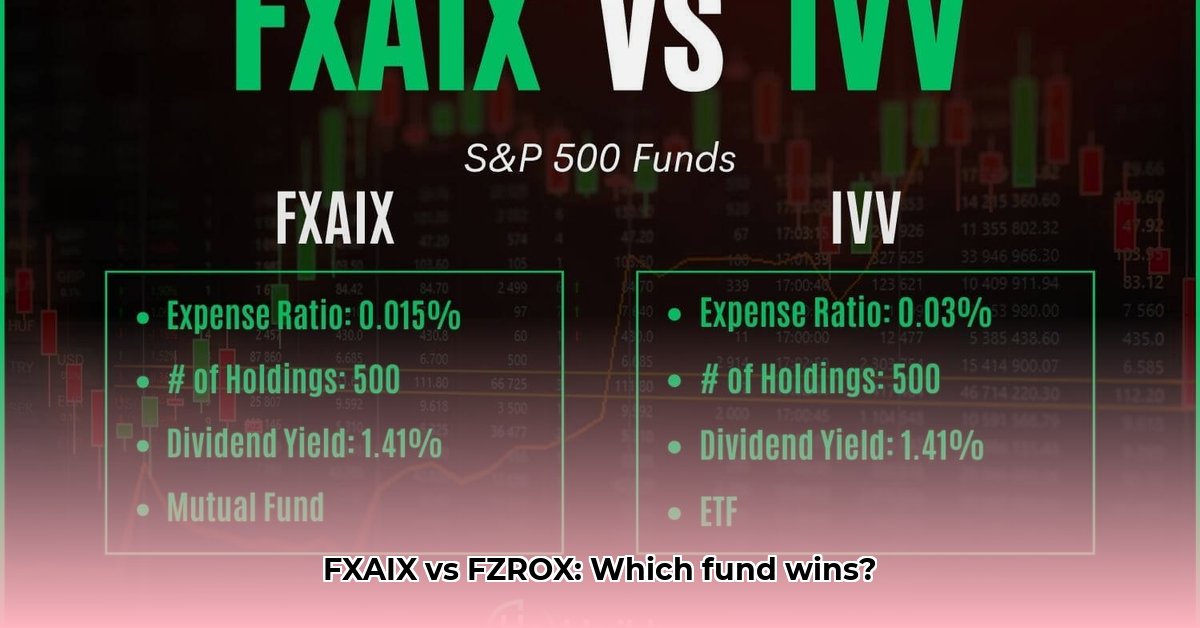

Choosing the right index fund for your investment portfolio can significantly impact your long-term financial success. This comparative review analyzes two popular Fidelity funds, FXAIX (Fidelity 500 Index Fund) and FZROX (Fidelity ZERO Total Market Index Fund), to help you make an informed decision. We'll explore their key differences, assess their risk profiles, and offer actionable advice based on your investment goals. For a broader comparison, see this S&P 500 Index Fund analysis.

Understanding FXAIX and FZROX: A Side-by-Side Comparison

Both FXAIX and FZROX are passively managed index funds, meaning they aim to track the performance of a specific market index, minimizing management fees. However, their underlying indexes differ significantly, leading to distinct investment characteristics.

FXAIX: Focusing on Large-Cap Stability

FXAIX tracks the S&P 500 index, comprising the 500 largest publicly traded companies in the United States. This focus on large-cap companies generally translates to lower volatility compared to broader market indexes. These established companies tend to be more financially stable, offering a potentially smoother ride, especially during market downturns. While offering potentially less rapid growth, it provides a solid core holding. It has a 0.02% expense ratio.

FZROX: Embracing Broad Market Diversification

FZROX, on the other hand, tracks the entire U.S. stock market, encompassing companies of all sizes – large-cap, mid-cap, and small-cap. This broader diversification significantly reduces the risk associated with investing in any single sector or company. Though potentially less profitable during periods of large-cap dominance, it mitigates against significant losses in various market conditions. Its key advantage is its zero expense ratio (0.00%).

Key Differences: Diversification, Expense Ratios, and Potential Returns

The core differences between FXAIX and FZROX lie in their diversification strategies and associated expense ratios, impacting long-term returns.

Diversification: Risk Mitigation vs. Potential Growth

FXAIX's concentration in large-cap stocks offers lower diversification, potentially leading to higher returns during bull markets but greater vulnerability during bear markets. FZROX's broad diversification across the entire U.S. market mitigates risk by spreading investments across numerous companies and sectors. This strategy generally leads to less volatility but may result in slightly lower returns compared to FXAIX during periods of strong large-cap performance.

Expense Ratios: The Power of Compound Savings

The seemingly small difference in expense ratios—0.02% for FXAIX versus 0% for FZROX—compounds significantly over time. While the annual impact may seem negligible, the cumulative effect over decades can be substantial, potentially adding thousands of dollars to your investment returns. This long-term cost advantage makes FZROX particularly attractive for long-term investors.

Potential Returns: A Balance of Risk and Reward

Historically, FXAIX, due to its focus on larger, more established companies, has shown slightly higher average returns than FZROX. However, this difference is often marginal, and past performance should not be considered an indicator of future results. The choice between higher potential returns (but greater risk) and lower, more stable returns depends on your investment timeline and risk tolerance.

Which Fund is Right for You? A Personalized Approach

The optimal choice between FXAIX and FZROX depends on your individual investment objectives and risk profile.

1. Long-Term Investors (Retirement Savings): For long-term goals like retirement, FZROX's broader diversification and zero expense ratio offer a compelling combination, providing a robust foundation for building wealth over decades. The slightly lower average returns are offset by the reduced risk and cost savings.

2. Income-Focused Investors: If you require regular income, FXAIX's historical tendency towards higher dividend payouts may be more appealing. However, remember that dividend payouts fluctuate, and this should not be the sole factor in your decision.

3. Risk-Averse Investors: Both funds represent relatively low-risk investments compared to individual stocks or other asset classes. FZROX's greater diversification offers further risk mitigation, making it a potentially safer choice for risk-averse investors.

Actionable Steps: Building Your Investment Strategy

Assess your risk tolerance: Are you comfortable with potential market fluctuations, or do you prioritize stability?

Define your investment timeline: How long will you invest the money? Long-term investments benefit more from FZROX's cost savings.

Consider your investment goals: What are you hoping to achieve with these investments? Retirement? Income generation? Growth?

Diversify your portfolio beyond single funds: Neither FXAIX nor FZROX should be your sole investment. Consult a financial advisor to create a diversified portfolio aligned with your specific circumstances.

Monitor your investments: Regularly review your portfolio’s performance and adjust your strategy as needed. Market conditions and personal circumstances can change over time.

Disclaimer: This review provides general information and should not be considered financial advice. Consult with a qualified financial advisor before making any investment decisions. Past performance is not indicative of future results. Investment involves risk, including the potential loss of principal.